10 Tips for First Time Home Buyers Looking to Buy in 2024

Stepping into the world of homeownership is an exciting yet daunting journey, especially for first-time buyers. As 2024 unfolds, the real estate market continues to evolve, presenting unique opportunities and challenges. If you're considering purchasing your first home this year, here are invaluable tips to help navigate the process:

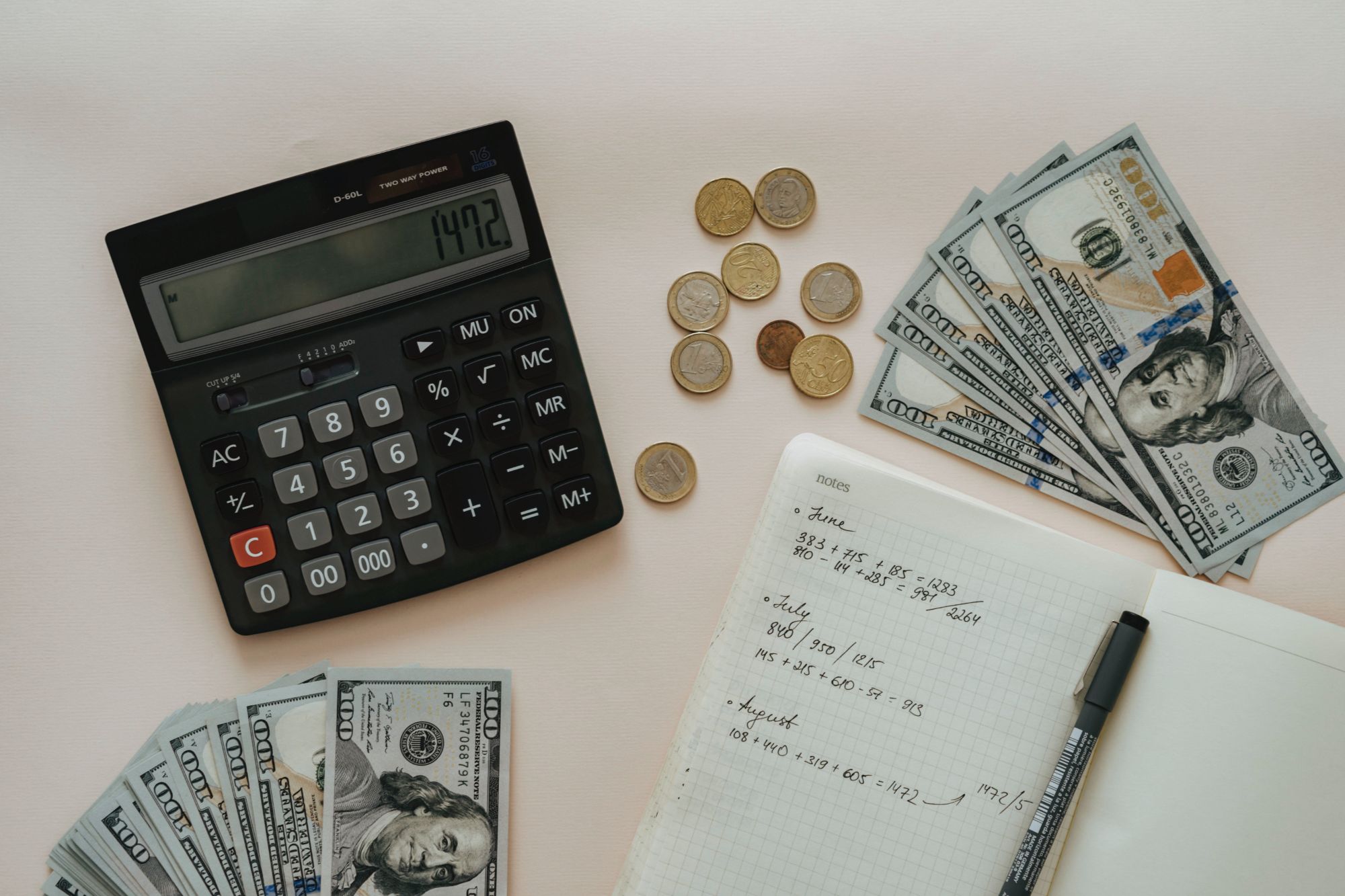

Assess Your Financial Readiness: Start by reviewing your finances and determining how much you can comfortably afford. Consider factors like down payment, closing costs, monthly mortgage payments, and other homeownership expenses. Understanding your budget is crucial before diving into the market.

Assess Your Financial Readiness: Start by reviewing your finances and determining how much you can comfortably afford. Consider factors like down payment, closing costs, monthly mortgage payments, and other homeownership expenses. Understanding your budget is crucial before diving into the market.- Get Pre-Approved for a Mortgage: Secure pre-approval from a lender before house hunting. It provides a clear idea of your borrowing capacity and strengthens your position as a serious buyer when making an offer on a property.

- Define Your Priorities: Make a list of your must-haves versus nice-to-haves in a home. Consider factors like location, size, layout, amenities, and neighborhood preferences. Having clear priorities will guide your search and decision-making process.

Research the Market: Stay informed about current market trends, property values, and neighborhoods of interest. Understand the local market conditions to make informed decisions and negotiate effectively.

Research the Market: Stay informed about current market trends, property values, and neighborhoods of interest. Understand the local market conditions to make informed decisions and negotiate effectively.- Find a Trusted Real Estate Agent: Seek guidance from a reputable real estate agent who understands your needs and has expertise in your target area. They can provide invaluable advice, help navigate the process, and negotiate on your behalf.

- Attend Open Houses and Inspections: Take advantage of open houses and property inspections to thoroughly assess potential homes. Look beyond aesthetics and evaluate the property's condition, asking pertinent questions about any concerns.

- Consider Future Resale Value: While envisioning your dream home, also consider its potential resale value. Opt for properties with features and locations that are likely to retain or increase in value over time.

- Factor in Additional Costs: Beyond the purchase price, consider ongoing expenses like property taxes, homeowner's insurance, maintenance costs, and potential homeowners' association (HOA) fees. A clear understanding of these costs is essential for financial planning.

- Be Patient and Flexible: Finding the perfect home takes time. Be patient and flexible in your search, but be ready to act decisively when you find a property that ticks most of your boxes.

- Get a Thorough Home Inspection: Prior to finalizing the purchase, invest in a comprehensive home inspection. It helps identify any underlying issues or necessary repairs, giving you peace of mind about your investment.

Categories

Recent Posts

Maximize Your Profit When Selling Your Home

Spring Sale Success using the Lucido Listing Blitz®

Spring Sale Prep PART ONE: Maximizing Your Spring Real Estate Strategy

Spring Sale Prep PART TWO: Preparing Your Home

Real Estate Investing: Avoid Costly Mistakes with Insights from Bob Lucido

Why Listing Now Could Be Better Than Waiting for Spring

SOLD Success using the Lucido Listing Blitz®

The Power of Compound Interest in Real Estate Investing

How One Investment Property Can Cover Your College Costs

Make Money While You Sleep: Passive Income Through Real Estate